Weekly Market Rollup, Week 3 Nov 2021

China play "weiqi" agains everyone, Alibaba 📉 again, ECB 🙅🏽♂️ rise % yet, American cannot afford ⛽️, Coffee is expensive, Turkey Lira 👎🏾. Ford ⛔️ Rivan, MacD mock Crypto trader, cash = 🤴🏼 .

Dear Investors, I’m going Minimalist for this week's newsletter. 😅

"To play it safe is not to play."

It seems like China & Russia play by that ideology as both countries warplanes entered into South Korea Air Defence Identification Zone and claimed it's theirs.

Meanwhile, the dispute between China & India over the 3,500km-long-deserted no man’s land border is still ongoing. As a democratic country, India repeatedly tried to end the ambiguity by negotiating a permanent border. But China has repeatedly rebuffed such efforts.

One needs to understand the ancient game of “weiqi” to have a glimpse of what's going on inside China's head. Unlike chess, where both parties try to control the middle ground (the center of the board).

In the game of weiqi, the objective is not to knock out your opponent as fast as possible. Instead, players first seek to build the largest, strongest structures and second, to weaken and stifle enemy ones.

Only time will tell how and when China will be world domination in economy or military.

China Playing with Nuke: When china declares they will be the world's largest Nuke user, I keep an eye on this raw material- uranium (Chart below). But to me, Uranium ETF does not offer a good investment opportunity at the moment.

_______

Alibaba: Strong market selloff even with Revenue rose by 29%. However, compared to the same period in the previous year, its slowest rate in six quarters.

This is due to the crackdown on anti-monopoly practices by the Chinese government a year ago. So now there are more competitors which eat up Alibaba’s market share.

_______

European Central Bank president, Christine Lagarde, said that inflation in the region, running at 4.1%, will “fade,” so monetary policy need not be tightened.

Meanwhile;

U.S.A: Real or Fake Recovery? The US stock market is making an all-time high, but does this mean the US economy is recovering?

According to an average of the past four weekly polls by The Economist, 46% of American adults believe the state of the economy is “getting worse.” In contrast, only 19% think it is “getting better.”

Stock Market is not an ideal indicator to be used for measuring a country’s economy health.

_______

Americans can feel the burden on price increase especially petrol. Joe Biden stepped in as the last-minute’s hero and directed the Federal Trade Commission to investigate whether oil and gas companies have been illegally keeping prices high.

Joe Biden also asked big importers of crude oil, including China, India, and Japan, to tap their stockpiles and help rein in soaring **energy prices**

China's effort to supplement power using Liquefied natural gas (LNG) might not seem to be enough, even with an Import increase of 14% this year compared to last year.

Demand For Crude Oil will likely continue if China decides to burn more oil if the energy crisis continues.

Technical:

Daily: Crude Oil topped around $86 per barrel after forming a wedge to. What follows is Double top (DT) which could lead to Major Trend Reversal (MTR)

Weekly: Strong move since early September suggesting a minor pullback. we still have Taken san (blue) & Kijun San (red) as support.

I see crude oil to climb higher in near mid term. (6 months)

_______

Inflation is surging around the world.

Due to poor weather, shipping snarls, and soaring fertilizer costs, coffee from Brazil to Vietnam sent prices to a seven-year record. Starbucks will likely suffer.

_______

On the other hand, Japan took a different path while the rest of the world has rising spending. As a result, private spending fell in the third quarter of the year and is now 3.5% below its end in 2019. This shows a weakness in Japan’s consumer recovery.

To conclude;

Inflation is real, what cause the inflation are the two basin major forces blended together. Supply-side constraints associated the pandemic & demand-side stimulus.

_______

Turkey’s central bank cut its benchmark interest rate by one percentage point for the 3rd time, sending the Turkish lira down further.

Ford canceled plans to develop an electric vehicle jointly with Rivian; an electric-truck startup said the firm intends to focus on its own projects and “win in the electric space.”

_______

Cryptocurrencies + NFTs: Bad news for the decentralized finance community, but good news for MacD.

Bitcoin started the week with a sell-off. The profit builds up from late July 2021 has reached an all-time high at $68K, which forms a double top. We can see across the NFTs space where there is not much of a buyer market. Everything in the crypto space drop.

MacD recently posted a job opening on Facebook. 😅

As the saying goes, “Don’t let a good crisis go waste.”

_______

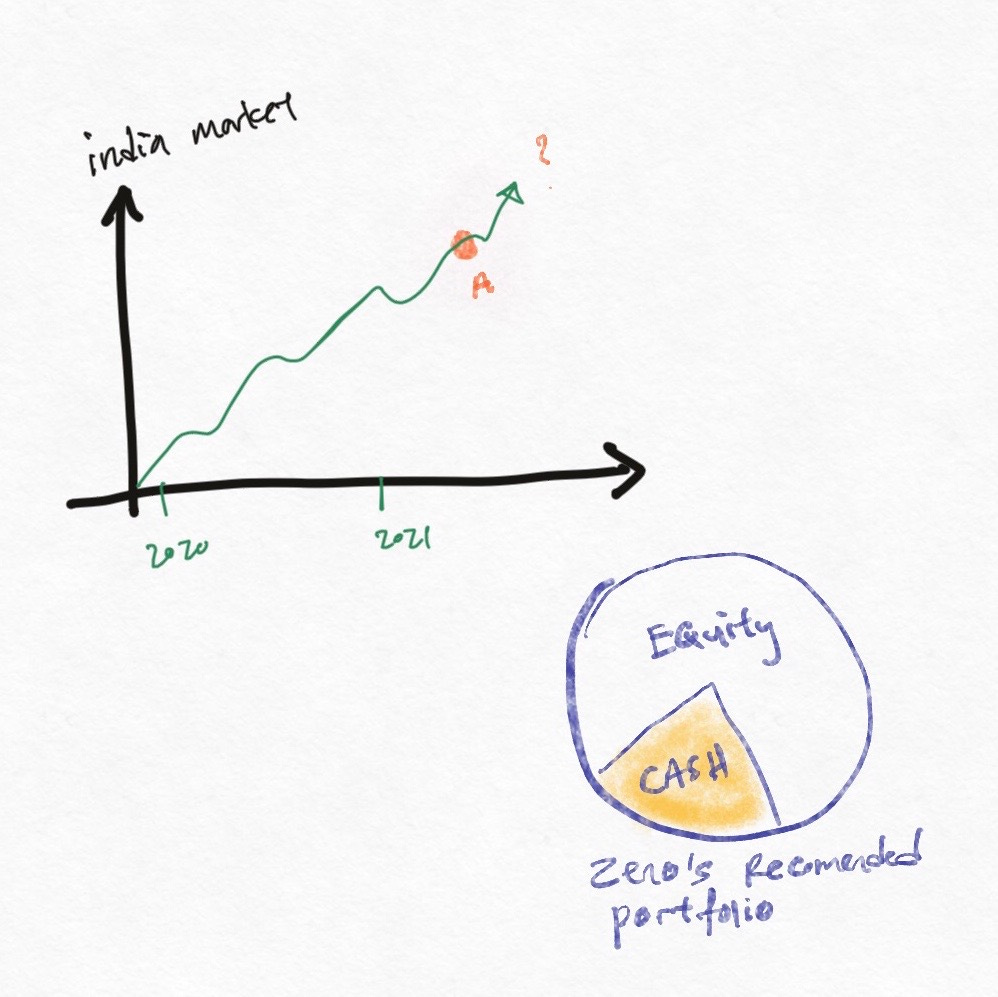

Cash is King: a good investor knows the importance of having a certain allocation of Cash / Money market in your investment portfolio & it is not a bad thing. However, many shy away from it, especially when they see other markets rising like crazy and want part of the deal.

Yes, money sitting in the bank or money market is just wasteful of earning almost zero interest. But cash has other benefits. For example, it can be a hedge for a sudden interest spike.

The majority of investors love to chase the rising star. Say India market, for example, is already up by 25% as of November. Yet people love to chase what is already high and go all investing in the market at point A (shown in the picture)

What novice investor fails to realize is market always move in a cycle. If you do not have some cash allocation in your portfolio, you might miss a good entry when the next crash happens.

_______

In closing: I recently purchased a book titled “The Compound Effect.”

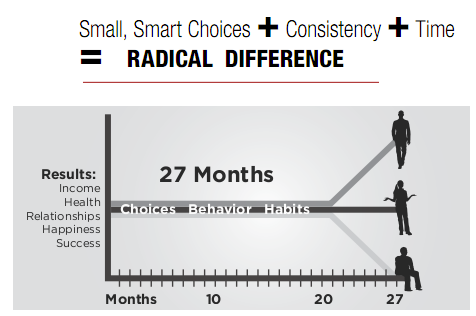

The book is about how small and smart choices we make every day, with consistency over a period of time, could yield a Radical difference in all areas of your life.

Tony robin once told Darren Hardy (the book writer) in January 2009 said, “I have seen many business moguls achieve their ultimate goal but still live in frustration, worry, and fear, so what is preventing these people from being happy? The answer is they focus only on Achievement and not Fulfillment.”

To conclude, life is not a sprint but a marathon. Therefore, we need to choose what small steps you can do today to bring you toward your life fulfillment in the coming 27 months.