Weekly Market Rollup Sept Week #4 2021

Nurse can't afford housing, Evergrade plunged, 40 mins for Tiktok , London Taxi fully electrified, US equity is back, Not enough Natural gas ,Tesla crash, Racing for new battery, Defi rabbit hole

This week, a lot is happening from TikTok to Evergrade, then a deep journey using autonomous electric vehicles into the rabbit hole where Defi rules. Then we dive the freaking expensive housing market.

1: The Green Future

China to stop building new coal-fired power projects abroad.

China plans to stop building new coal-fired power plants in other nations, threatening to end one of the last international funding sources for the dirtiest fossil fuel. President Xi Jinping said that China would support other developing countries in developing green and low-carbon energy and not build new coal-fired power projects abroad. More than 70% of all coal plants built today rely on Chinese funding.

_______

London’s largest taxi firm will be fully electrifying its fleet by 2023.

2: China The Asia Dragon:

The crackdown on developer’s debt- Evergrade on the brink of collapse.

The world’s most indebted property firm with $300bn in liabilities and expected to default on its interest payment on September 23rd. The ripple effect also caused Sinic Holdings, another real estate developing company, to collapsed by nearly 90% on September 20th. This also resulted in the price of iron ore fell below $100 per tonne on September 20th for the first time in a year on fears that Chinese homebuilders will construct fewer properties.

According to Xi Jinping, this is China's “common prosperity” blueprint for remolding the country - even though China’s property sector accounts for 20-25% of its economy, some bad apples need to be clear of the baskets.

What caused Evergrade’s collapse was its bad business model. The company has relied on ever-increasing short-term debts, often at higher and higher costs, to fund a business model that relies on borrowing money to develop properties and selling them years before they are completed to generate cash from buyers’ deposits.

When the central government stepped up its campaign against highly leveraged businesses, it fell.

It's only when the tide goes out that you learn who has been swimming naked - warren Buffett

What changes?. Authorities have constricted developers’ capacity to accumulating debt.

Limiting liability-to-asset ratios to less than 70%,

Net debt-to-equity ratios to less than 100%,

Mandating levels of cash that are at least equivalent to short-term debt.

Meanwhile, Ping An Bank and Minsheng Bank have both also been hit by sell-offs recently. As a result, both had 10.6% and 10.3% of their total loan books extended to property groups.

Both bank stocks favor more downside moves.

side notes for my investors:

Eastspring dinasti equity fund have NO exposure to Evergrande stock.

However our Globack Target Income Fund have 1% + exposure.

To conculude: Any moves in the client’s portfolio should be small and tactical. Be thankful for the risk and try to visualize the return you will get three-to-five years out by sticking to your plan.

_______

Chinese video-sharing app with an international version called TikTok said children under 14 in China would be limited to using it for 40 minutes a day.

3: Freakonomics

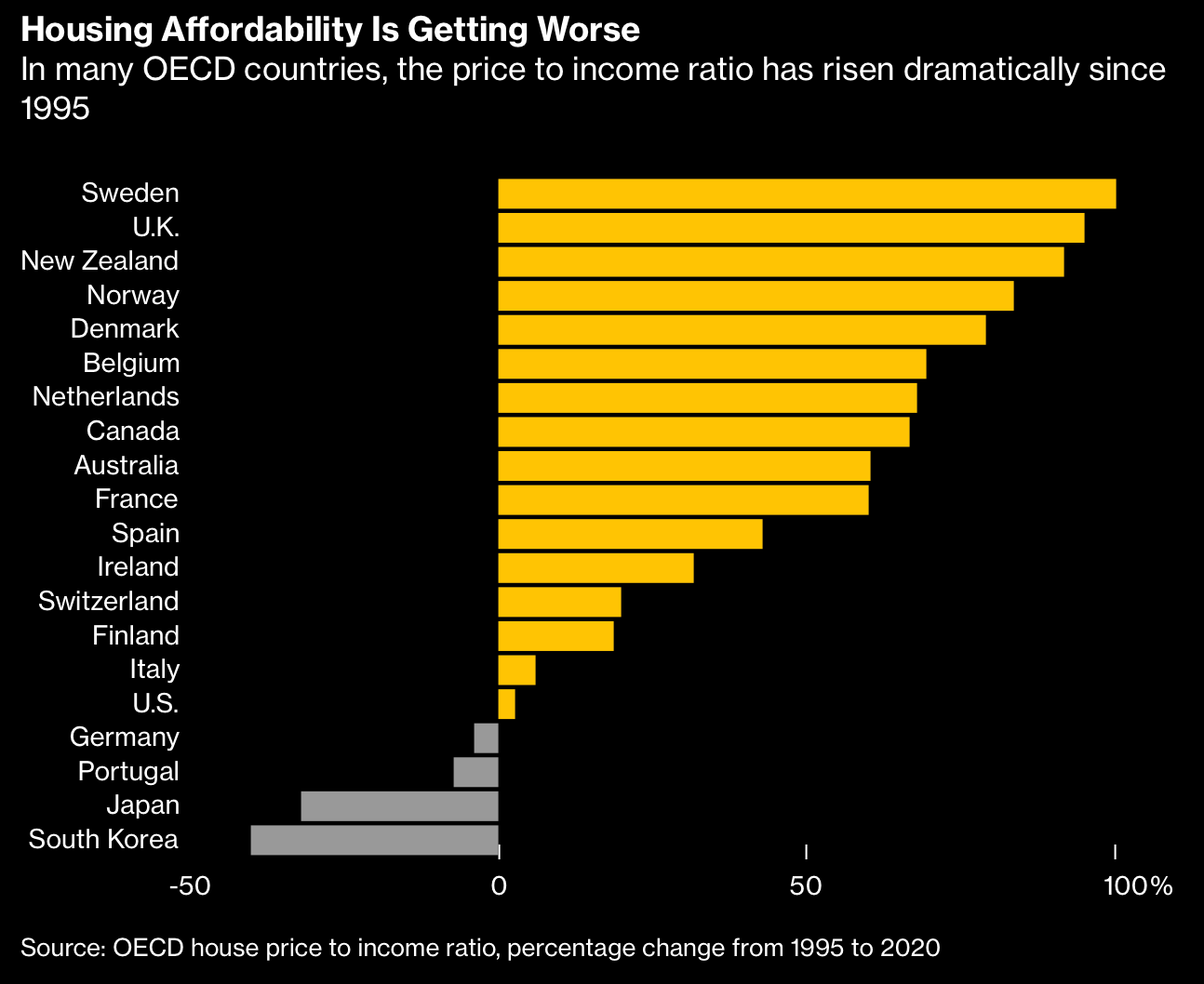

The Global Housing Market Is Dividing Entire Countries

The dream of owning a home seems out of reach even for professionals that just entered the workforce.

It all starter with the pandemic. When the economy experienced a flash crash in March 2020, the government implemented fiscal stimulus, including interest rate cuts, to allow cheaper borrowing. While this, in my opinion, only favors the Rich with deep pockets as they can not go to the bank and borrow more money and sweep properties at the floor price.

The result, a widening generational gap between Baby Boomers, who are statistically more likely to own a home, and Millennials and Gen Z — who are watching their dreams of buying one go up in smoke.

4: Market @ A Glance:

The US Stock Market Still Moving in “Steady State”

There have been some hiccups in the US equity market the past 2 weeks, but momentum started to come back this week. I would expect more upside move next week.

_______

$BDRY - supply chain shortage is a gain for investor that invest in this ETF. YTD gain 309%++

5: Supply Chain:

The market is frantic about natural gas.

As a result, prices of power in Germany and France have soared by around 40% in the past two weeks.

Notes:

America, the world’s biggest natural-gas producer

The Asia region accounts for almost three-quarters of global LNG imports

The high demand is mainly contributed by China's fast post-pandemic economic recovery in the first half of 2021; its power generation jumped by 16% compared with the previous year.

3/5 China power supply is generated by coal - but China environmental policy has made a demand for coal drop. ( refer to section 1: China to stop building new coal-fired power projects abroad )

1/5 comes from hydropower - but hydropower generation has been low because of a drought

That meant more reliance on natural gas.

$UNG (United States natural gas ETF) up 77.70% YTD.

6: Wheels on Fire

Tesla Being Investigate

Two people were killed on September 13 when a Tesla crashed into a tree and caught on fire in Coral Gables, Florida. The lithium-ion batteries that power Tesla models and other EVs are highly flammable and difficult to extinguish. Once damaged, they can reignite for hours or days.

Chart-wise on the weekly looks weak. It’s forming a lower high wedge top. It can move lower to test at least $560, bringing tesla into a trading range.

_______

The Future Of Mobility Won’t Just Be Electric…

Because all vehicles will be C.A.S.E (connected, autonomous, shared & electric)

Intel’s Mobileye and car-rental company Sixt announced plans to start an autonomous robotaxi service in Germany next year.

Volkswagen and Argo AI plans to launch an autonomous ride-sharing service, also in Germany, by 2025

Let’s look at case adoption

Breaking down C.A.SE

Connected: Offer over-the-air software upgrades and infotainment services as well as safety and convenience features

Autonomous: automatic emergency braking and lane-keeping assistance

Shared: Shared e-hailing Services like Uber, Grab.

Electric: Electric vehicles like Tesla, Nio, etc……

7: Tech Crunch:

China is already moving on to the next leg in the race of Battery.

China’s Contemporary Amperex Technology Co. or CATL, the world’s largest battery manufacturer, will produce a sodium-ion battery (old technology) that offers a cheaper, faster-charging, and safe alternative to the current lithium-ion battery.

The sodium-based batteries aren’t going to take electric cars any further than lithium can. However, the materials needed to make them are widely available.

Sodium-ion batteries could be about 30% to 50% cheaper than existing options, with a major cost advantage. - with this, the Sodium-ion battery's role can be towards energy storage rather than to be used in EVs.

8: The New World: Crypto, Defi, Metaverse & Beyond

The Rise Of Decentralised Finance, or “DeFi,” is imminent.

What is Decentralised Finance? Think of the traditional finance like banks that pay you interest when you save with them or charge you % if you borrow money. Next, think of the New York Stock exchange that allows you to trade stock, Option, ETF, etc.…; the Forex market lets you trade currencies and the auction house that lets you bid for antique collectibles.

Then put all that into a blockchain - there you have it Decentralise finance. But wait, what is the difference?

In traditional finance, all transactions must go through an entity such as banks, brokers, and another middle person to maintain trust between strangers.

The new word of DeFi offers an alternative path that aims to spread power back to the community. A peer-to-peer technology connects users directly with lenders, borrowers, payments, and investments, without middlemen such as banks, brokerages, exchanges, and asset management companies.

There are literally hundreds of blockchains to date. The first-ever build was Bitcoin back in 2009, followed by Etherium in 2015. But among all the blockchain, I am most interested in Etherium blockchain because most DeFi applications are built there, reaching critical mass.

When the blockchain revolution started 13 years ago, no government authorities gave a dam about it until we see exponential adoption by the public in recent years. But, unfortunately, hedge funds and the big corporations also want a piece of the cake - that’s when the authority stepped in.

The tweet below that happened on 24 Sept 2021 shows how the government trying to prevent this technology revolution. My previous newsletter mentions how the US government tries hard to regulate Defi and wishes to implement heavy taxes.

On 24th September 2021, China made a bold announcement. After spending almost 1 year cracking down all business in China, from tech companies to education, gaming, and property, now they come back to the blockchain - again.

Crypto revolution is like the when internet first discovered back in early 1997; nobody at that time believed the internet might one day become crucial in our day-to-day lives. I believe crypto technology will be heading in the same direction.

______

Twitter’s push into Crypto.

Twitter will let users send and receive tips using Bitcoin to help users make money from the service.

Twitter also is looking into authenticating users’ nonfungible tokens (NFTs). What it means is they want to Authenticate that person actually owns the profile picture used.

For example, the profile picture that I use in my Twitter account is actually an NFTs own. You can verify the ownership of my NFTs here in the Ethereum Blockchain.

_________

SEC is pushing hard for centralized exchange.

Coinbase dropped plans for a crypto lending program after the Securities and Exchange Commission pushback. - now you can see the downside of a Centralized system. It can be controlled by the authority.

For those who are well informed in the decentralized world, Lending and borrowing can be done in 1. Aave, 2. MakerDAO & 3. Compound. An alternative to the centralize market.

9: Opinions

Becoming a matured investor.

As a professional athlete, you learn from your coaches to go narrow and deep and perfect in executing your moves. It’s the same as an investor. You adopt attributes from mentors or the person you look up to. We can be good at a lot of things but can’t be great at everything.

Make your investing philosophy simple & stay in your circle of competence. Learn to say not to certain deals which do not align with your philosophy/circle of competency often create future opportunities.

A month ago, I invested in a digital project that cost me about $16K. I invest in it because of the hype around that projects and many influencers and celebrities alike making tons of money in just a matter of days and weeks.

Unfortunately, my investment landed in a project with great futuristic ideas but bad management - everything went south. Investing in digital projects is something out of my core competency. I would have to get a better result if I put the $16K in equity, cryptocurrencies & Defi. - This is opportunity cost.

_______

The end of Expat?

Once upon a time, In the golden era of globalization, sending Western ex-pat executives to a distant emerging market because they are experts in certain fields. They used to be the link between the western sources of capital and know-how.

Everything changes, money is abundant, and the most exciting business opportunities are emerging markets doing business with other emerging markets, particularly in Asia. Therefore the need for ex-pat dented.

Even if an ex-pat is needed in a niche sector, there are solutions. Thanks to covid-19. As Zoom and remote work has become the new norm. The company can now save on housing allowance, school fees, annual flights home, and a healthy salary given to the ex-pat by the company.

That’s all for this week. if you like what you see, you can subscribe to this free weekly newsletter.