Weekly Market Rollup Oct Week #4 2021

Jack Ma spotted, Fuel of the future, The Rich can’t sleep, Linkedin shut down, Something weird happening in N.Korea, DJI all time high!, Bitcoin ETF, Uber allows to cut queue, Netflix & AAPL 🚀

Jack Ma finally appeared almost one year after disappearing from the public eye. He made his first trip abroad for a holiday in Spain. He was last seen almost a year ago after being summoned by Beijing, followed by his controversial speech. That was the beginning of china's crackdown.

Subscribe—> its free. Deliver straight to your email. No spam what soever, only good stuff.

1: The Green Future

The Fuel Of The Future?

Can hydrogen (the most abundant element in the universe) help end the world's dependence on fossil fuel?

Governments are spending billions of dollars each year to fund the clean-hydrogen revolution. But, what happened recently has the world shifted they paradigm towards a greener fuel:

In September, Chevron unveiled a $10bn strategy for “new energy” that bets big on low-carbon hydrogen.

bp, ExxonMobil, Royal Dutch Shell and TotalEnergies—have also announced investments in hydrogen clusters and technologies

Aramco says that the Saudi Arabia state-controlled oil colossus intends to be the world leader in fossil-derived low-carbon hydrogen in the 2030s. They want to maintain their energy superpower by exporting hydrogen made using its solar & wind resources.

On October 11th, Australian richest man Andrew Forrest, a mining tycoon, plans to build the world’s biggest factory for electrolyzer machines. This machine is needed to produce green hydrogen from water.

Air Products, the world-leading hydrogen supplier, is developing several hydrogen megaprojects around the world.

Why is the world shifting from a scared commodity like oil into green hydrogen - besides, it’s better for the environment? Because hydrocarbons are here forever, and don’t think anybody can disrupt them.

Today, technological advancement making hydrogen production more efficient and cheaper + government effort to net-zero carbon world is helping to drive the Hydrogen revolution.

2: China The Asia Dragon:

Wealthy Chinese are hiding their wealth - they aren’t sleeping well these days.

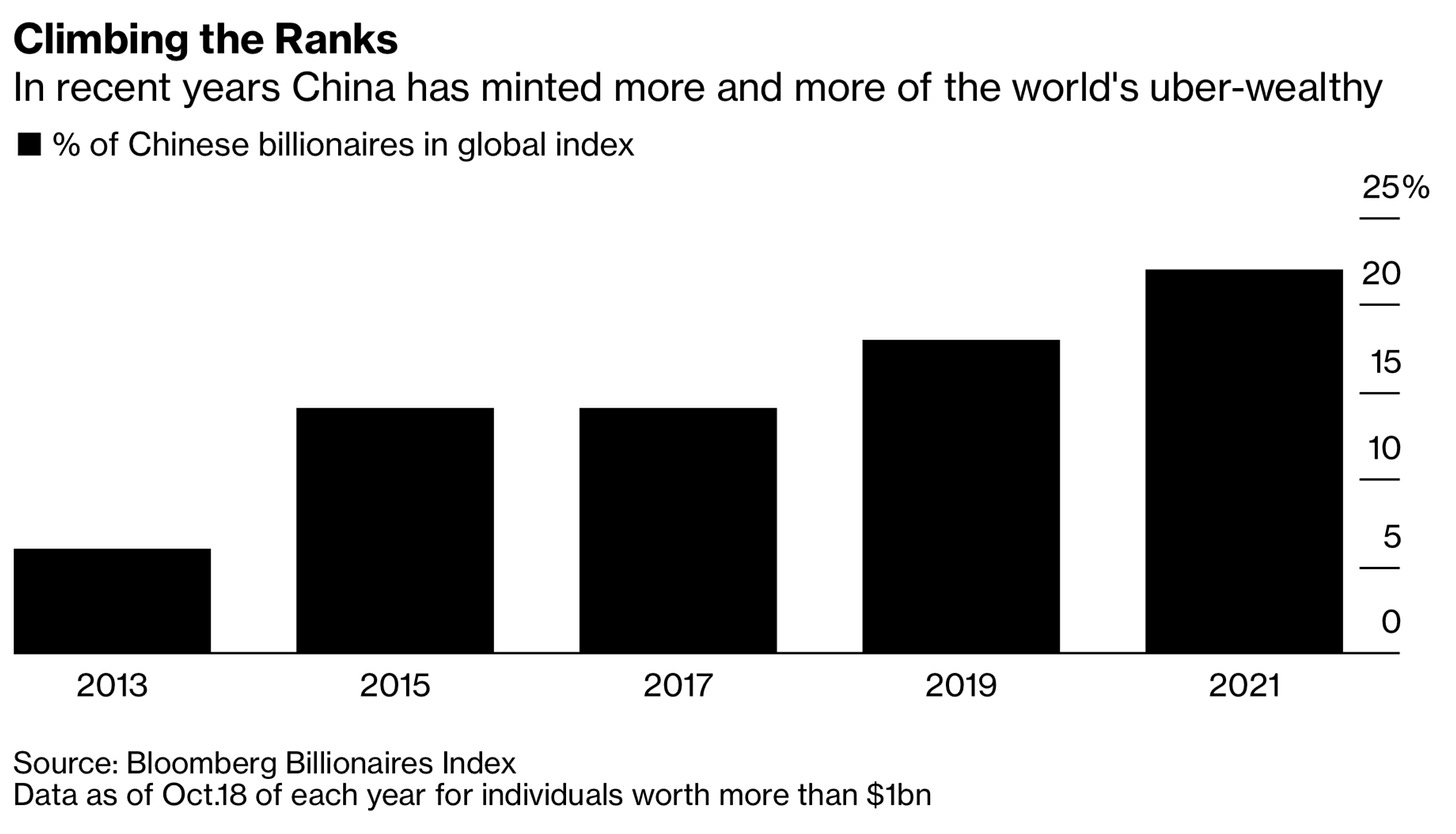

China has created a new billionaire every week in 2021, bringing the total to more than 750 -- more than India, Russia, and Germany combined - where the US recorded 830 billionaires.

The move by President Xi towards common prosperity & to narrow the gap between the rich & poor is what is feared by that superrich. So they become defensive, deleting social media profiles s and trying to lay low, moving money around - fearing the next crackdown.

Now the theme has changed; the rich switch their theme from making money to protecting it.

Moving money is hard for Chinese citizens. They are only allowed to convert $50,000 per year.

Beijing has also made it illegal for Chinese people to trade crypto - not to protect their citizens from the volatile market but to prevent them from funneling money abroad.

Demand for underground exchange increased, which private bankers took a commission as high as 20% per transaction.

Another way is to use peer-to-peer transfer.

Right now, China doesn’t tax inheritances, but the wealthy worry it’s only a matter of time.

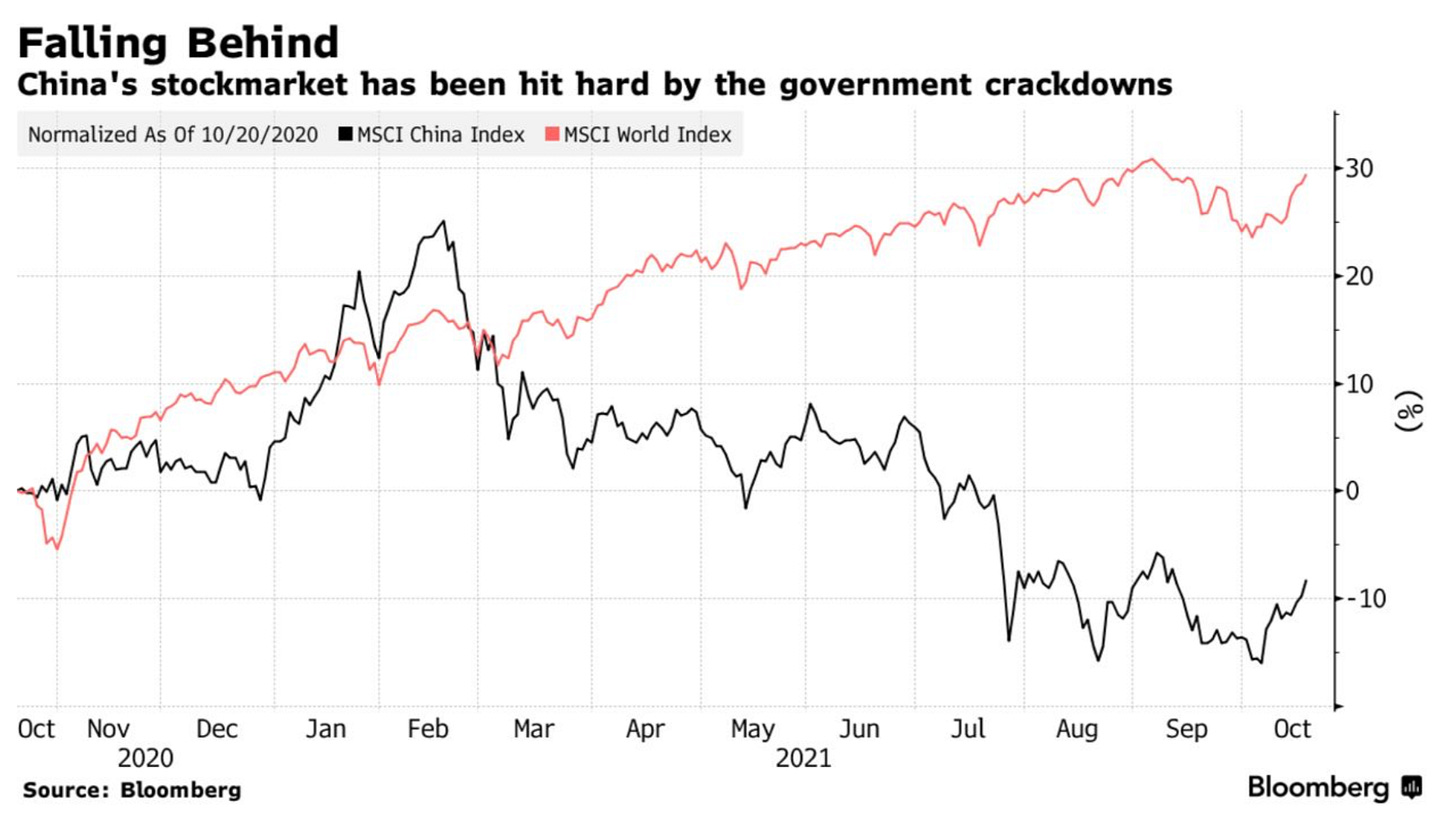

With China falling behind the rest of the world, it will be a good opportunity to position your portfolio in this universe while it’s cheap. When the tide change direction, you will be thankful for a diversified portfolio.

_______

LinkedIn is Shutting down

Microsoft will shut down Linkedin operations in China due to strict compliance requirements.

_______

China New Education

As the local Chinese education system will be remade under Beijing, Hong Kong teachers will be tested on the city’s national security law. The exams would bring requirements for teachers in line with those facing other civil servants in hope to foster teacher & students' national identity."

_______

Double-Digit Price Hikes on China

Chinese exports are forecast to rise 21% this year, the biggest jump in over a decade. As a result, shipping costs were up by almost 300% higher than a year ago.

The U.S. Bureau of Labor Statistics import prices index shows price increases of about 3%-5% for Chinese-made goods such as electrical equipment, household appliances, and footwear.

Secondly, A global rush for raw materials means Chinese factories face the fastest rise in input prices in almost 26 years. In addition, factories could face a 20% hike in their electricity costs due to a power crunch. This could lead to manufacturing costs being increased.

3: Asia, truly Asian

Something Strange Happening In North Korea

North Korea faced the toughest sanction in its history. Massive flood damage, Pandemic cut off most trades facing the worst food shortages in more than 10 years.

In normal economies, currencies weaken in times of difficulty. However, the North Korean won has jumped 25% against the dollar this year.

The jump in NK won it can be linked to the following;

pandemic. When the border closure happened in 2020, imports into North Korea crashed; thus, demand for overseas currencies fell. China, N.Korea's biggest trading partner, dropped more than 90% from august 2020 to February 2021.

The N.Korean government effort in boosting the won. Many retail outlets in the capital Pyongyang have stopped accepting dollars or prepaid overseas currency cards from foreigners in the country and instead ask them to pay in won.

Financial authorities were ordering residents to report their holdings of foreign currencies and deposit them in banks.

The drop in trade and strengthening currency point to a broken economic system

4: Freakonomics

Inflation is expected to stay high due to a crunch in energy markets and supply chains issues, except for Britain’s annual rate of inflation dipped slightly to 3.1%.

European gas prices surged again when Russia said will not increase its supply in the coming weeks.

Note: Russia provided 43% of the European Union’s gas imports last year

China’s GDP grew by just 4.9% in the third quarter Y-O-Y.

5: Market @ A Glance:

US Stock market finally close with All-time high - Again

6: Supply Chain:

Taiwan Semiconductor - playing the waiting game.

TSMC said it sees revenue rising about 24% this year, faster than earlier projections, although Chip capacity is expected to remain tight for the rest of 2021 and into 2022.

7: Tech Crunch:

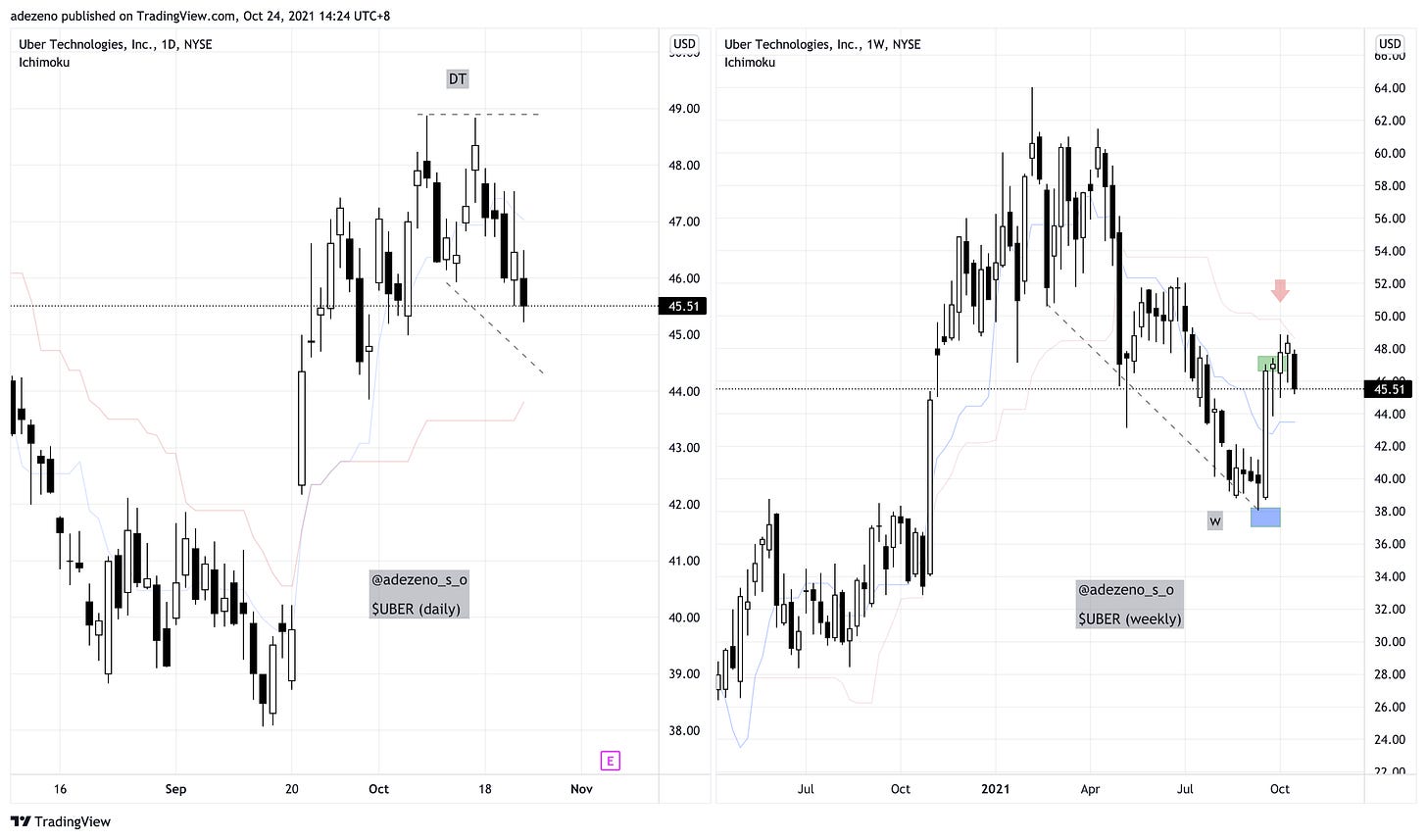

Uber is testing new features.

Uber Technologies Inc. is now allowing some users in Brazil to pay more for shorter wait times - as they face fewer drivers to meet higher demand. It will cost as much as 20% more than the basic fee and is available based on demand.

technical:

daily: Uber making double top, looking for high 2. still above Kijun.

Weekly: Wedge with 1 supprice bar, so alway in long, however still on the down trend (red arrow) indicating lower high, but wil can still bet on the Strong bull bar to be always in long.

Notes: wait for daily to show momentum .

8: The New World: Crypto, Defi, Metaverse & Beyond

America first Bitcoin ETF

Welcome to America’s first bitcoin-linked exchange-traded fund listed in New York. Investments are made in bitcoin futures, not the cryptocurrency itself

Ticker symbol $BITO

_______

While the world Crypto held increased scrutiny from regulators worldwide, this is what the president of Russia said.

“Cryptocurrency “has the right to exist and can be used as a means of payment,” Putin said in an interview with CNBC”

_______

Tether Fine $41 Million For Lying About its Reserved

For years, Tether, a stable coin widely used to trade Bitcoin and other cryptocurrencies, told customers and the broader cryptocurrency market that it had $1 in reserve to back every token.

From June to September 2017, 442 million coins were circulating, but there was never more than $61.5 million backings it.

9: Stock On the move:

Netflix:

4.4m subscribers signed up in the third quarter, taking its total customer base to 214m.

Netflix share price $NFLX took off, closing the week at $664.

Apple

remember last week when we discuss Apple stocks, it’s making a move. (green = my entry)

technical:

weekly: the stock is still sitting nicely above kijun.

10: Opinions

What do you actually need in an insurance policy?

To end this week's Newsletter, here is something you might want to look into - for your own personal financial planning.

and if you want to learn some “hack” to your life insurance, here you go,