Weekly Market Rollup Aug week #3 2021

Dip buying? Hong Kong exodus, Bitcoin breaking the roof, Emerging Market-investor latest favorite, Malaysia New PM. $ZIM, $INMD to the moon. Eastspring New Fund.

Buy the F**king Dip.

This was the mantras chant by most traders & investors alike in the past 2 years. The dip-buying strategy works like a charm for the US equity market as the market never drop more than 5% this year.

However, the China market has caused some investor to reach their breaking point as the market continues to bleed due to regulatory crackdown. Short-term investors that jump in the market expecting a rebound get devastated.

Hang Seng Tech Index down -43% February this year.

* Another round of Crackdown: China is studying separate proposals to ensure further the rights of drivers who work for online companies & to step up oversight of the live streaming industry. (Source- Bloomberg)

** China has passed legislation setting out tougher rules for how companies Tech companies like Alibaba Group Holding Ltd., Tencent Holdings Ltd and Didi Global Inc. handle user data. Restrictions on moving personal information across borders & required that any critical information be stored within China. (Source- Bloomberg)

Currently, we see investor’s money flows into other emerging countries that avoid china for the obvious reason.

Compare to US Nasdaq, which up +62% since January 2021.

The moral of the story is. Nobody is smart enough to be able to predict any market accurately. Even if you have seen someone does, he has not runs out of lucks. The best thing to do is diversify your portfolio into different sectors and universes.

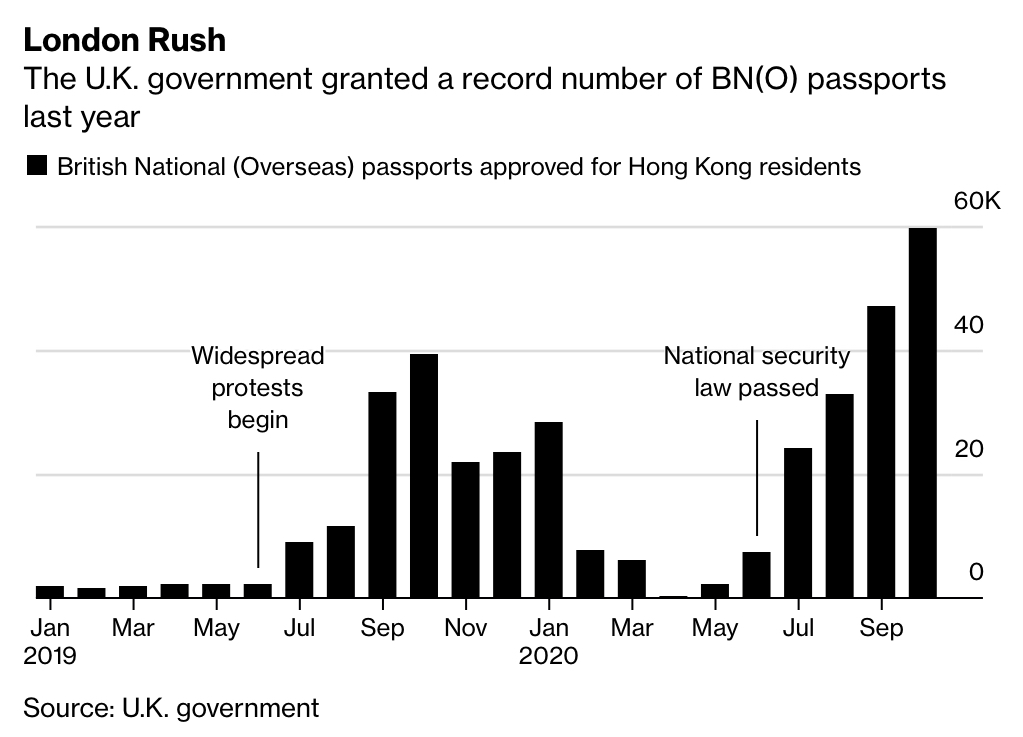

Hong Konger Great Exodus.

A record number of British passports was approved for Hong Kong residents since the widespread protests in 2019 and the National Security law passed. More Hong Konger is trying to flee the country, but China makes it hard for them by denied access to money in the Mandatory Provident Fund. (Like Malaysia’s EPF money)

The U.K. government anticipates more than 300,000 residents will use the passport to leave Hong Kong, putting billions of dollars at risk of being trapped.

Malaysia welcome back UMNO after their loss in 2018 as New prime minister Sabri Yaakob being elected.

This year has been a bad year for Malaysia's Blue-chip stocks. Last year's super runner stock, Topglove down -62% this year.

However, market sentiment starts to change 4 days ago (purple arrow) as the new prime minister is elected. This does not indicate Malaysia's equity market to rebound from here as selling pressure on the weekly chart is still strong & we should continue to monitor from here.

Site note: Malaysia's OPR (overnight policy rate) is the lowest in history. Now Bank said No more BLR, No more BR. It shall be renamed as SBR (standardize Bank Rate). This is actually great news for consumers as it hinders commercial banks from playing tricks on the lending rate.

Watch how this Malaysian Financial Youtuber explain the new SBR

Consumer Guide on the Revised Reference Rate Framework

Bitcoin seemed to clear some roof (Resistance)

Below is the Bitcoin ($BTC) weekly chart. Here is some layman term you need to know.

Floor = preventing price from falling further.

Roof = preventing price from moving up further.

When the price of Bitcoin falls in April this year, the price hit the floor at around $28,000 on 19 July 2021. Since then, Investors are piling up cash on this digital asset. (More hedge fund and banks allows their customer to invest a portion of their assets in Bitcoin and Etherium)

The momentum is too strong that it broke the Roof this week, where the price currently stands at $49,200. However, there are more reasons to believe BTC will soon trade above its previous high at $64,000.

*technical entry (based on weekly) Market always in long. ;)

Stock On The Move

This week Stock on the move.

$INMD 8.77% in 2 days.

2. $ZIM +12%

What I’m excited about

Eastspring Investment is launching its first Islamic China A-share in the coming months. This allows investors to tap into the most undervalue China mainland market.

I shall brief this in my next article. so stay tune