The Rise of Malaysia Market

14 points investor needs to know why the Malaysian market is heating up right now.

Malaysia Stock Market Return (1)

The FBMKLCI Index registered a 12% year-to-date (YTD) gain before a recent pullback. Thanks to Utility, Construction & Property.

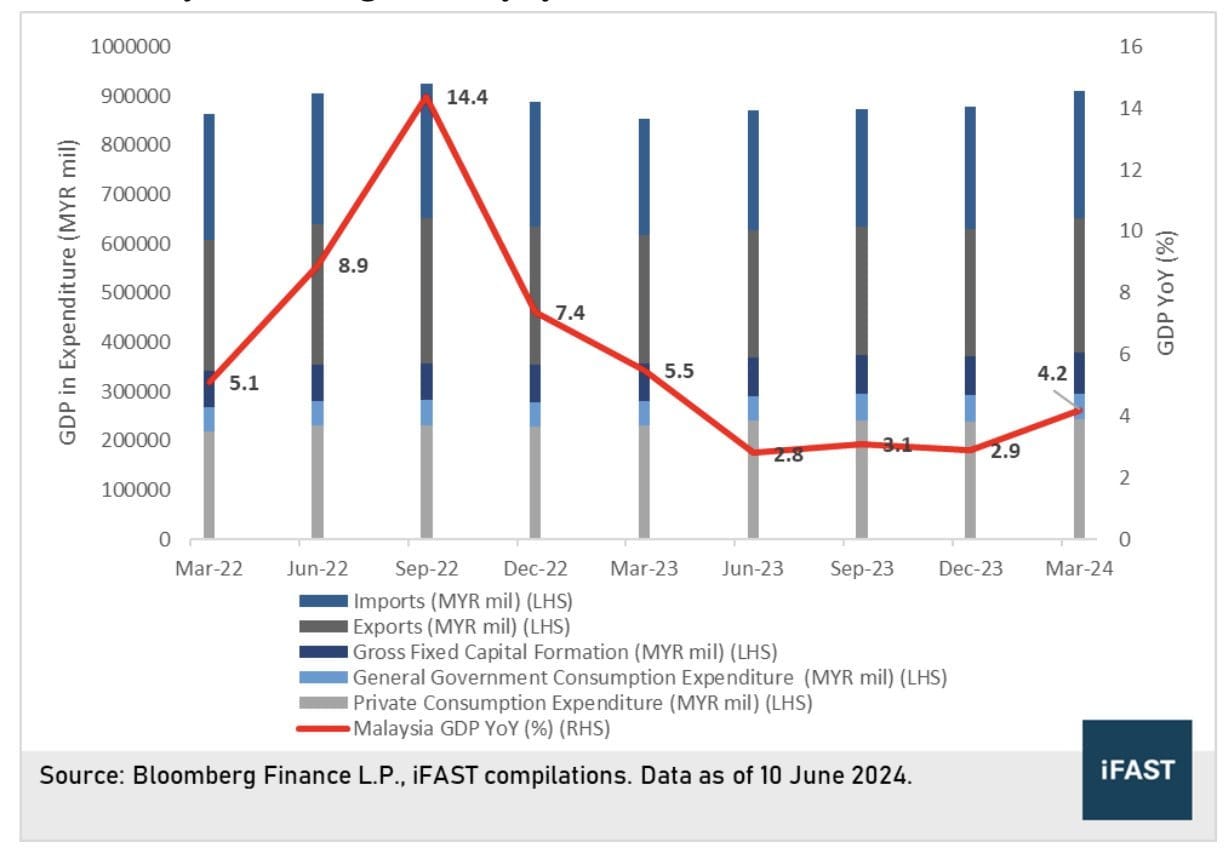

Faster GDP (2)

Malaysia's economy grew at a faster rate of 4.2% in the first quarter of 2024, surpassing the initial estimate of 3.9% y/y

Stable inflation (3)

Malaysia's annual inflation rate remained steady at 1.8% for the third consecutive month, in line with market expectations.

Targeted Subsidies (4)

Malaysia's recent diesel subsidy cuts are unlikely to significantly raise inflation. While the removal of subsidies could impact certain sectors, the government’s cash handouts and targeted subsidies for specific businesses aim to mitigate the effects. -

The new diesel price announcement could reduce the government's annual expenditure of approximately RM 4 billion on diesel subsidies

Reduces Expenditure (5)

When Prime Minister @anwaribrahim took office, the fiscal gap was 5.6%, and the national debt stood at RM 1.5 trillion.

In 2024 the government aims to replace broad subsidies with targeted assistance to help reduce the 2024 budget deficit to 4.3% of GDP, down from 5% in 2023

Malaysia Maintains Its OPR (6)

Bank Negara Malaysia is maintaining its current overnight policy rate as this is sufficient to support economic growth while managing inflation.

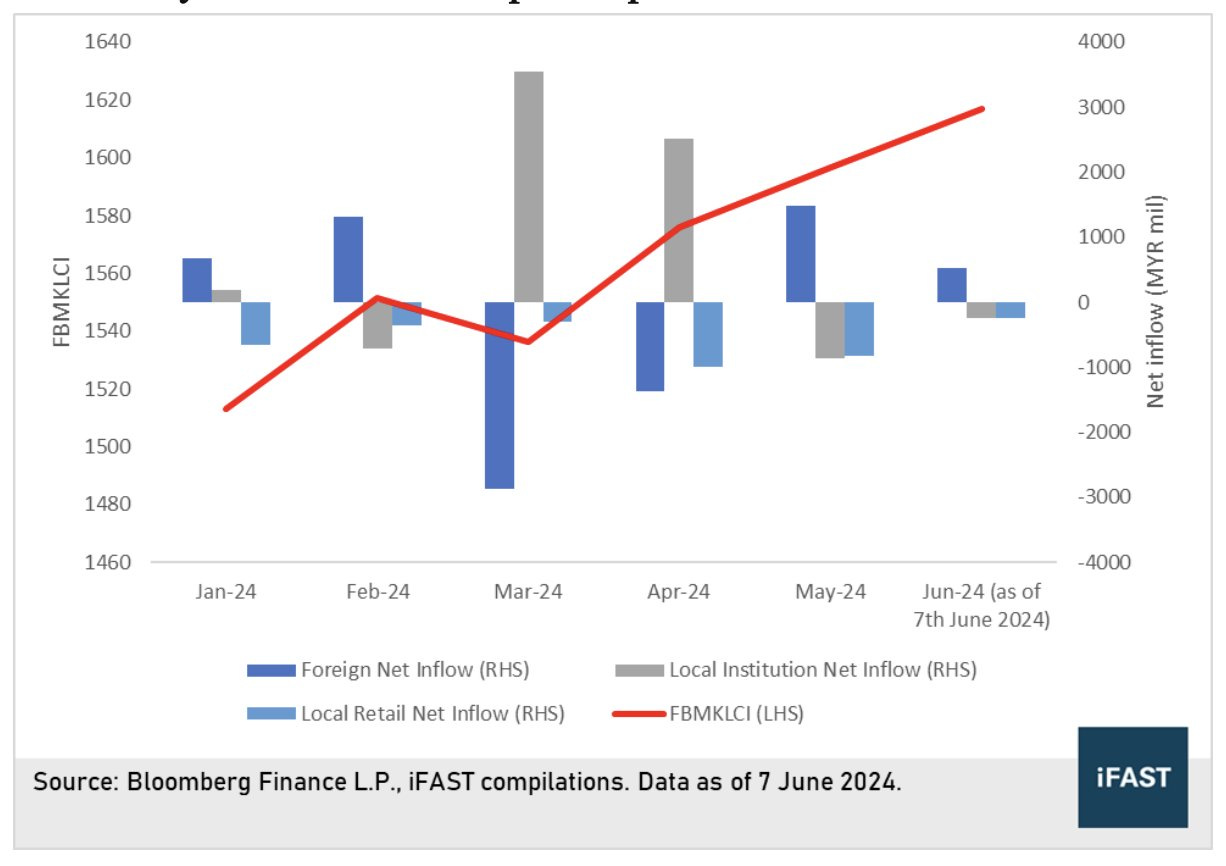

Malaysia Investment flow (7)

Changing Expectations: Investors initially thought the US Federal Reserve would cut interest rates six times this year. Now, they only expect two cuts. This change has led to net selling in Malaysia.

So..

Potential Boost: If the US Federal Reserve decides to cut rates more than expected, it could attract more foreign investment to Malaysia.

and with

Local Support: Even though there was net selling by foreign investors in April, local institutions have been supporting the Malaysian stock market.

Malaysia EPS projection (8)

The financial sector (banks, etc.) is doing well despite slower loan growth and less income from interest. It’s like a sign of how our whole economy is doing. -> See the last section for Unit Trust funds recommendation.

Consumer Discretionary Sector Suprise. The part of the economy related to things people choose to spend on (like hotels) bounced back strongly. Their profits are back to what they were before the pandemic.

Experts think companies will still make good profits, even though we’re not sure how subsidy changes will affect things.

The four Asian Tiger! (9)

In the 90s, Malaysia stood out as one of the ‘Four Asian Tigers,’ and its foray into the E&E sectors, infrastructure development, and industrialization in Penang shaped its economic landscape.

multinational corporations to consider Malaysia as a preferred destination for reshoring- outside China,

Thanks to its mature ecosystem, infrastructure, and supportive policies. Foreign Direct Investment (FDI) signals strong interest, highlighting Malaysia’s potential to integrate global technology into domestic growth

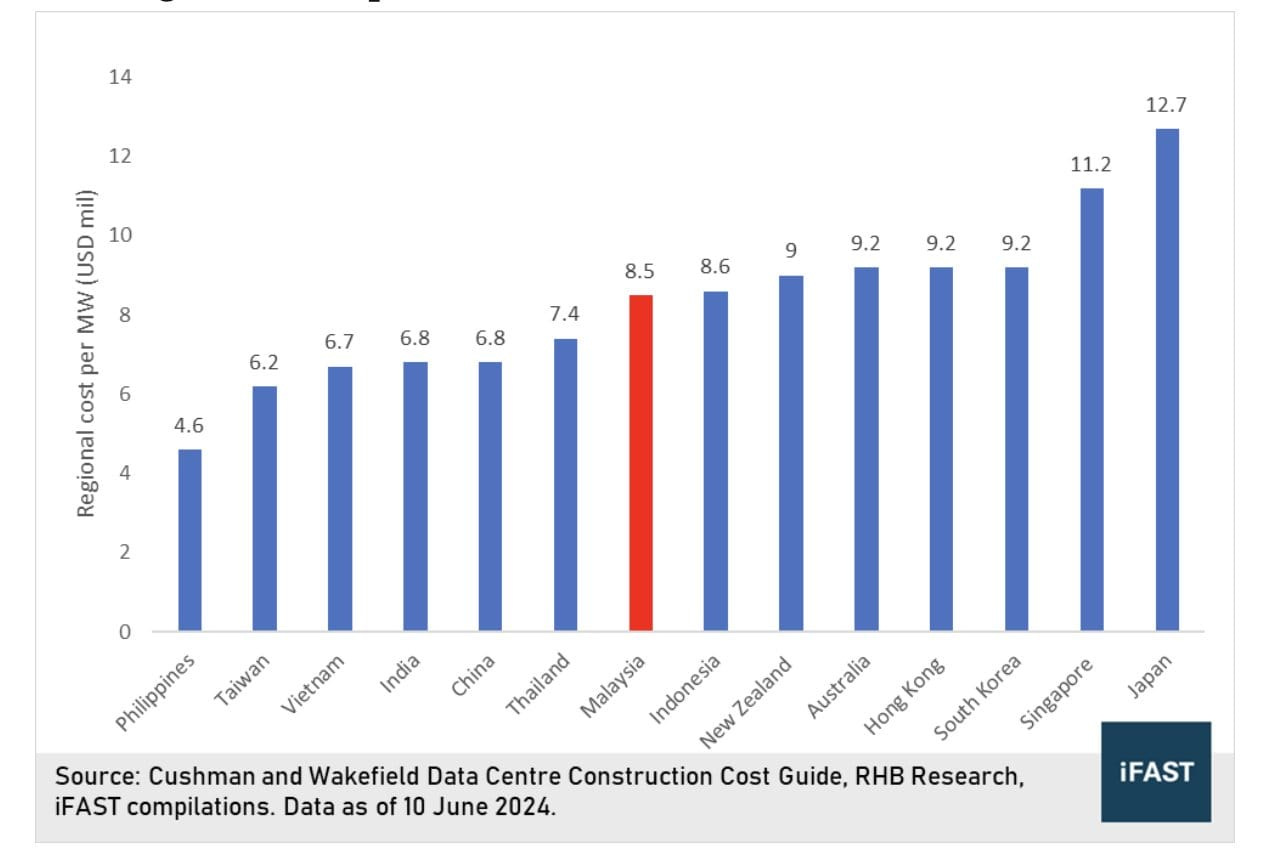

Data Center is the next catalyst (10)

Data Center is the next catalyst that is booming, especially in Kuala Lumpur and Johor. Johor has emerged as an alternative hub for hyper scalers, while Kuala Lumpur, particularly Cyberjaya, attracts co-location operators serving retail-level enterprise customers.

Notably, global tech giants like Google, Microsoft, Nvidia & Equinix have recently invested in Malaysia

Why Malaysia is the best choice?

Affordable land,

low electricity costs, and

ample water supply for cooling systems.

Side notes: The power demand from the data center will increase a lot in the next few years. Therefore some Utility companies in Malaysia will benefit from this - See the last section for fund recommendations.

Penang to be the ASEAN Silicon Valley (11)

In April, global semiconductor sales surged to $46.4 billion, growing 15.8% year-on-year and 1.1% month-on-month—the first such increase in 2024.

Meanwhile, Malaysia’s semiconductor sector is poised for improvement, fuelled by global demand recovery and the China Plus One strategy, with Penang emerging as a hub for semiconductor giants

East Malaysia set to be a new economic powerhouse (12)

The government’s target of expediting the construction projects including telecommunication, water, and electricity infrastructures is largely on track.

Indonesian capital relocation to Nusantara will provide geographical advantages for East Malaysia companies with easier accessibility to goods and service

Malaysia’s Stock market is still cheap (13)

Overall valuations are still reasonable, located below the 10-year historical average level

Now Let's dive into the last part. Technical Chart & Fund Recommendation

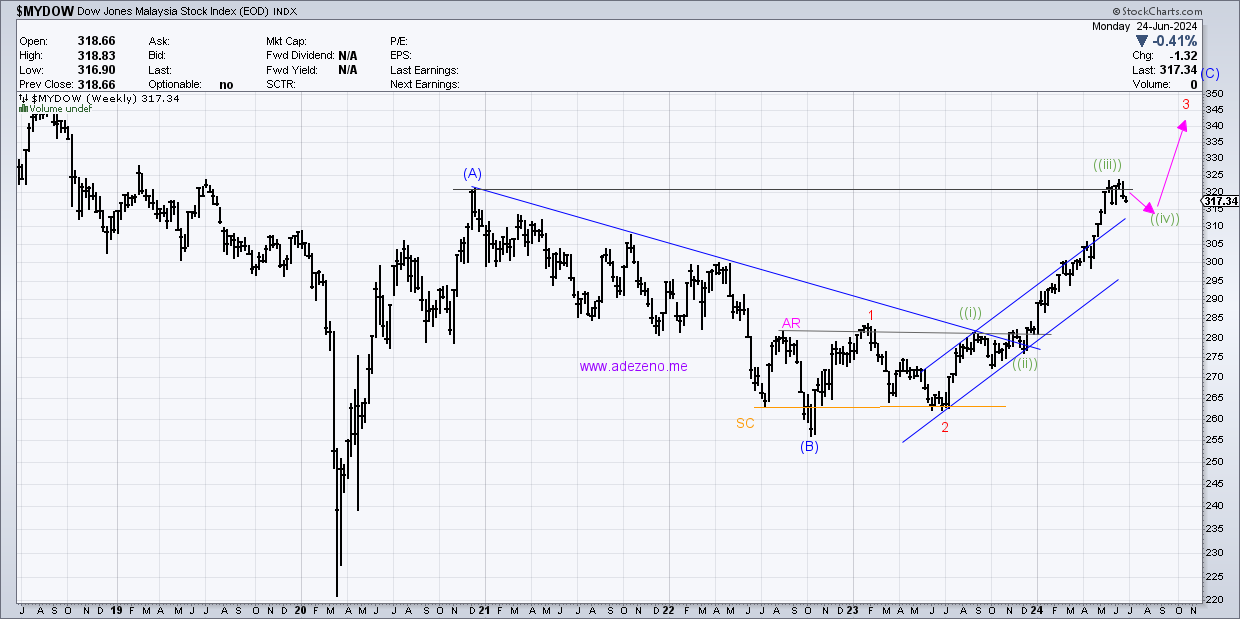

Strong TA to support fundamental (14)

So for fund recommendation, I suggest Eastspring Investments My-Focus.

This is a very concentrated fund. imagine a coffee. purely coffee, no water added. This is why you can see the top 5 holdings are banks and one utility company TNB

Why the banking sector? -> See point no: 8

Why TNB, a utility company? -> see point no: -> See point no: 10

and you can see the fund has been outperforming Bursa Malaysia Since the year 2013.

So on top of capital gain, you will also receive a yearly dividend distribution yield of 4.8%.

Have a great day :)

-savviv : Save & Invest for your future.