What is MIS?

It simply stands for Member Investment Schemes.

Our Government allows EPF members to withdraw a particular portion of their money in EPF account 1 to invest in selected Unit Trust Funds.

First, You need to know how EPF works…

Say your earn RM 5,000/month. You will contribute 11% & your employee will contribute 13% from the basic salary.

This will made up of RM1,200/month to be contribute to your EPF fund.

From the EPF fund, 70% is allocators into your account 1. Which you can never withdraw, EXCEPT for Unit Trust investment Purpose only.

30% will goes into Account 2. This smaller portion you can withdraw for the following purpose.

Pay for your student loan, (PTPTN)

Buy house / Renovation

For Medical Cost.

For Muslims’ Haji.

Let’s assume Your are 30 years old now. And your EPF Account 1 Balance is RM 60,000.

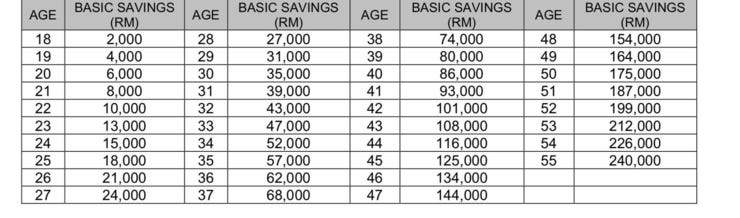

Check your basic saving rate below. For age 30, it is RM35,000

RM 60,000 - RM 35,000 = RM 25,000.

then

RM 25,000 x 30% = RM 7,500 <— now this is the your withdrawal eligibility.

The Easy way:

Step 1:

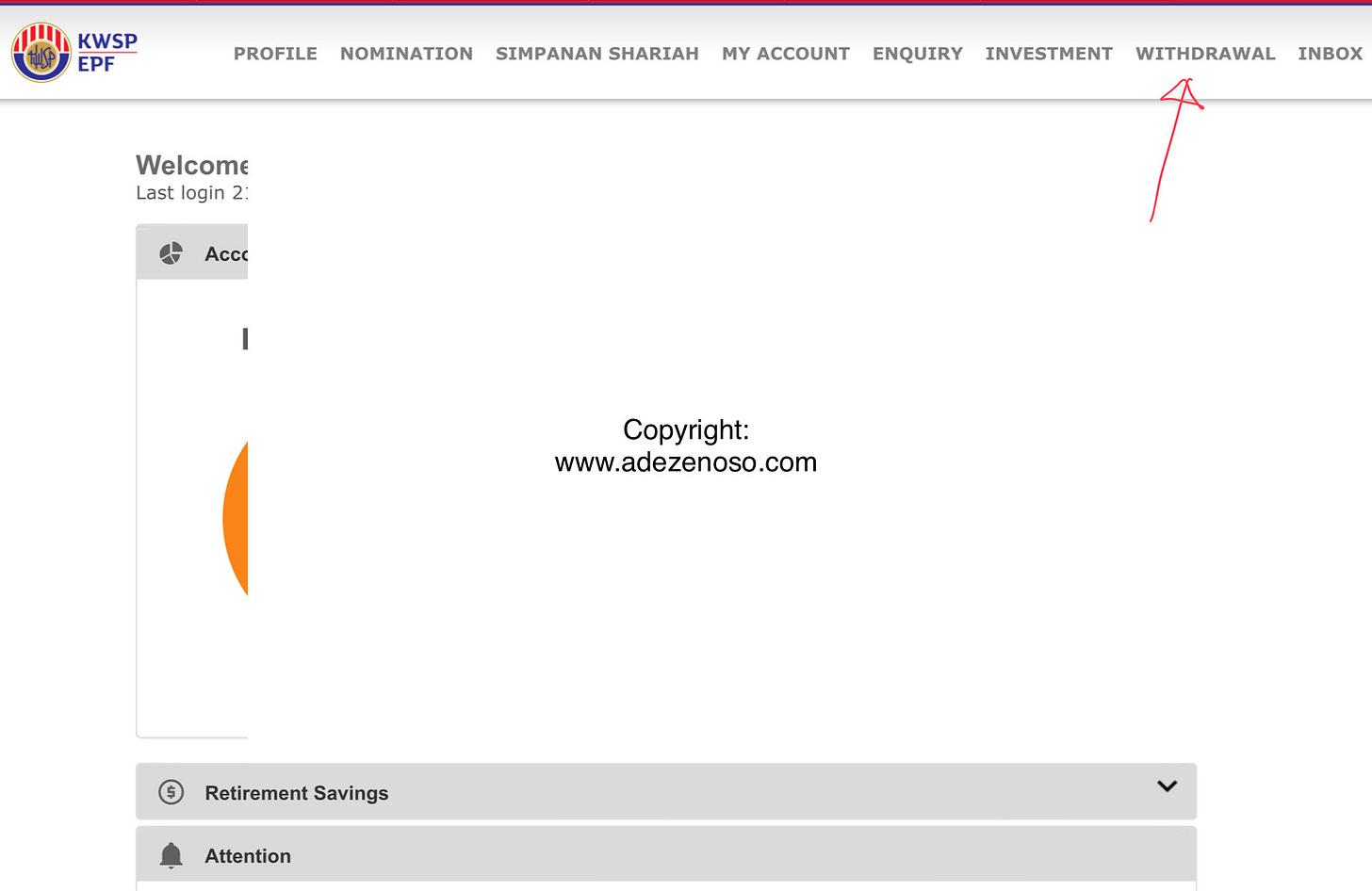

Login to

Username is usually your IC no:

*Click forgot User ID/password if you don’t remember.

Step 2:

Click Withdrawal on the top right.

Step 3:

Select withdrawal eligibility on the side bar

Step 4:

Look for member investment schemes.

On the right side, that is the amount you can invest.

Now that you are qualified, the Next is to know which fund to invest in.

Subscribe for more info like this deliver straight to your email. :)