Why China + India Strategy?

Global GDP is expected to grow at 3% in 2024 & 2025. China & India are expected to grow by 5% & 6.8% this year and by far the highest GDP growth among nations.

Why china? China has the largest middle class with the fastest-rising household disposable income.

Why India? India has the world largest youth population setting the foundation for high GDP growth.

By 2030, Asia Could represent 2/3 of global middle class population

Housing remain the largest drag for china economy.

China property investment stayed weak at -10%. Property sales decline by -18%

However other key economic indicators shows a steady upward trajectory with accelerated export.

In terms of market valuation, India is expensive. While china dirt cheap.

Although India valuation is not cheap.

But corporate earning is strong.

Corporate Earning growth remain strong for year 2024 and 2025

India has a strong foreign and domestic flow

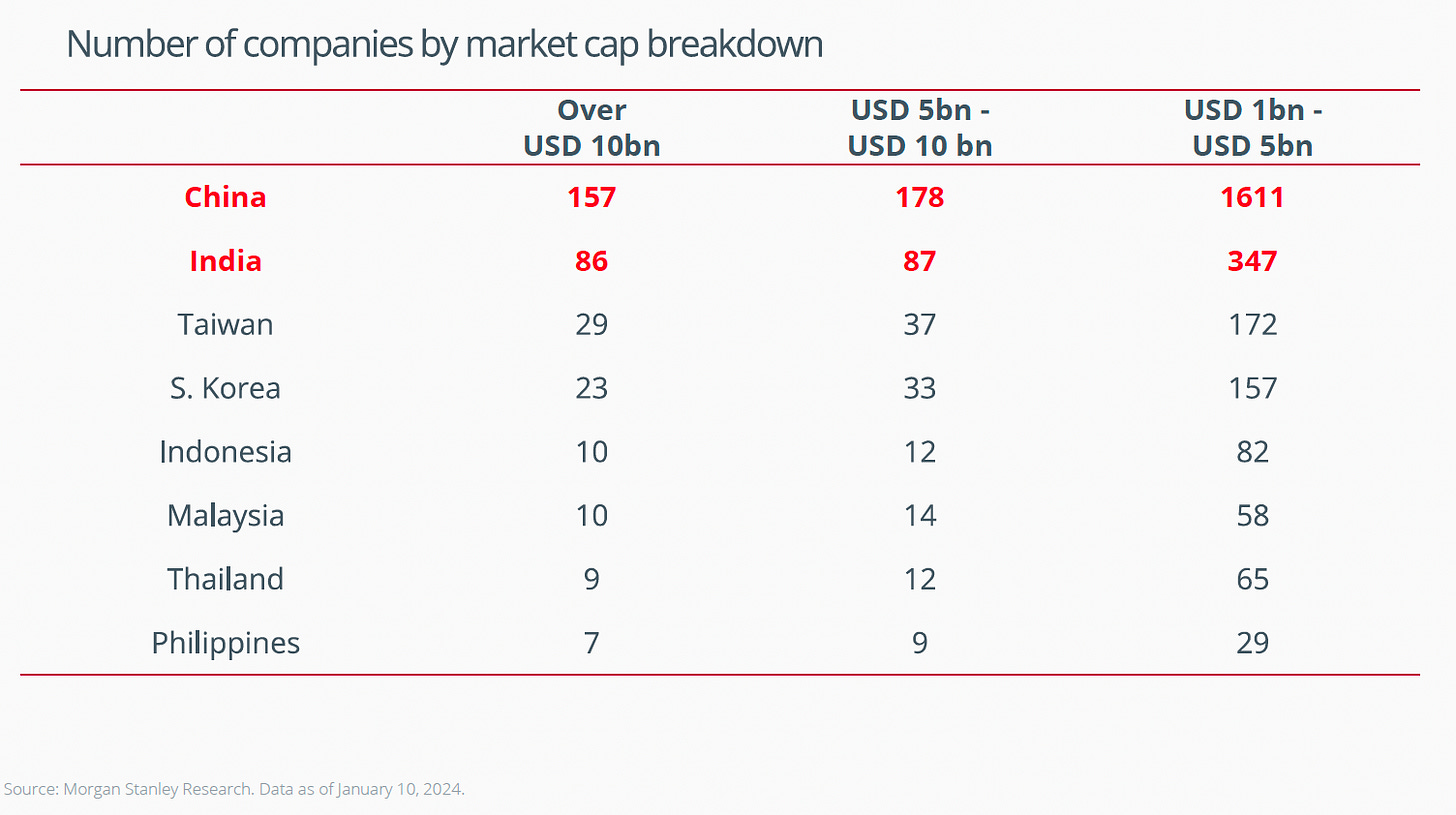

China and India equity market have many stocks to choose from.

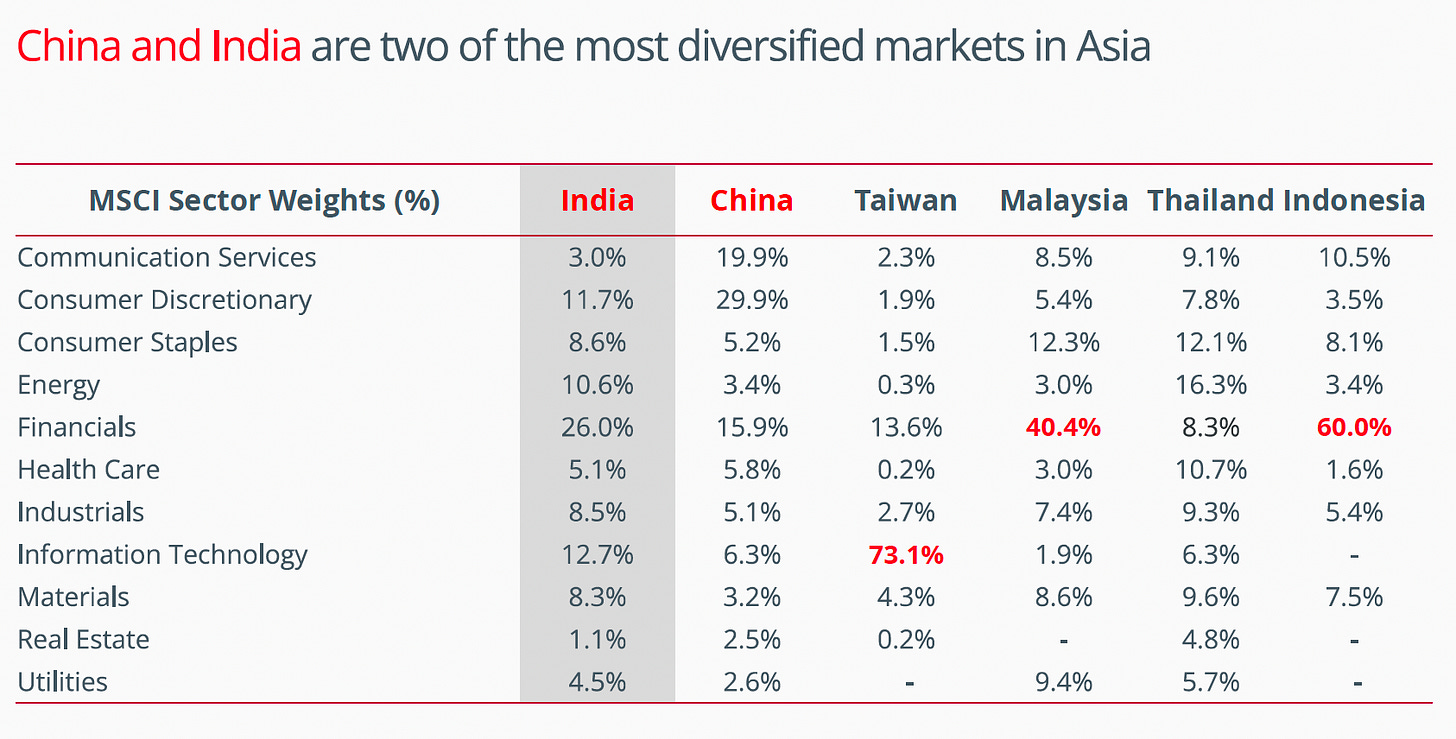

China & India are two of the most diversified market in Asia. Unlike Taiwan, 70% of the sector are into IT, while Malaysia and Indonesia majority of the sector are into Financial and banking.

If you adopt an investment approach that combines 50% China and 50% India, you would have outperformed the Asia ex Japan, Developed Market, and Emerging Market indices since 2005.