A Life insurance "Set-Up" That Ensures Legacy For Next Generation

How this simple Insurance setup can give your spouse a passive income for 25 years, and help 3 children to fund their tertiary education.

Part 1: Just Incase

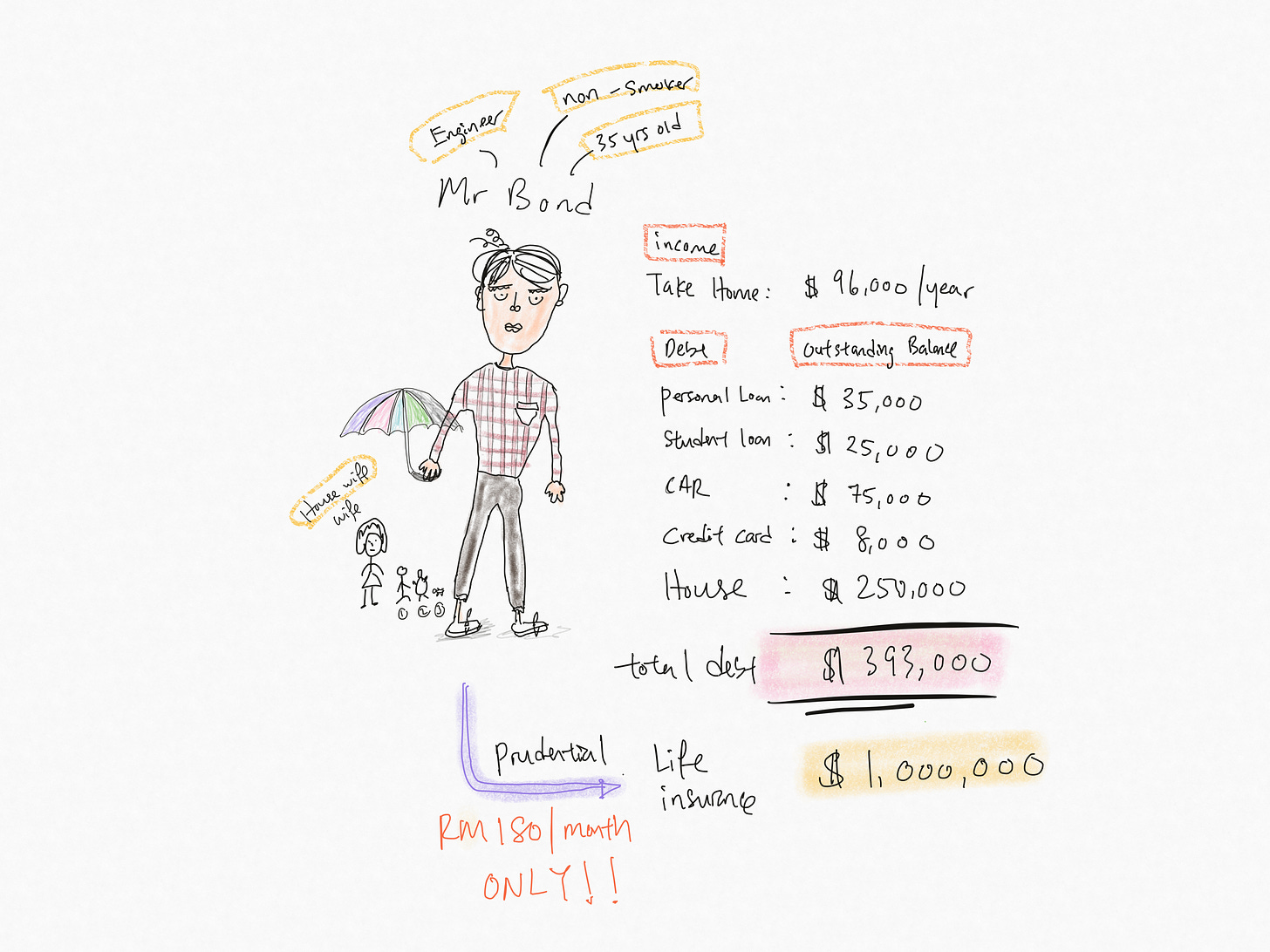

Introducing Mr. Bond. A 35-year-old professional engineer. I married a beautiful full-time housewife. Both of them were blessed with 3 cute children.

Mr. Bond's annual Take-home income is RM 96K with a total debt of RM 393K.

(Refer pic 1)

Mr. Bond is Smart 🥸, With Only RM180/month, he got himself covered with RM 1 million from Prudential.

( I use Prudential as an example because I represent that company 😅)

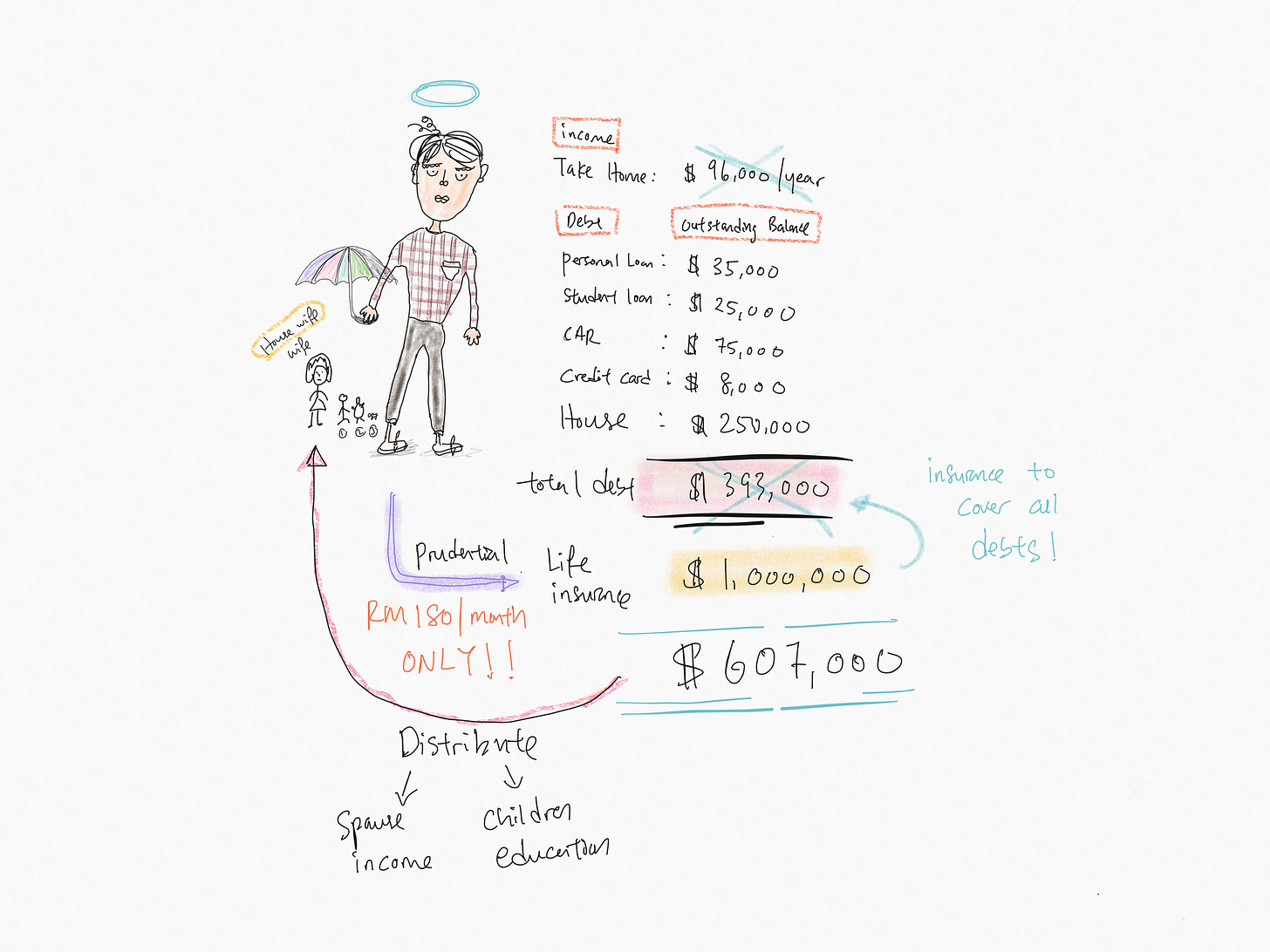

If “Something” happened to Mr. Bond (Death, Disablement), Prudential will payout a lump sum of Rm 1,000,000 to Mr. Bond’s wife, which she can use to settle all the debts (Rm 393,000)

Mr. Bond’s wife will still be left with RM 607,000 for

Family Living Expenses

Children Education

Now the next part, This is my expertise. read on.. but be warned.. it gets a little technical. 😅

Part 2: The Legacy Continues…

The first part is getting suitable life insurance. The 2nd part is to make sure the insurance payout money is properly managed.

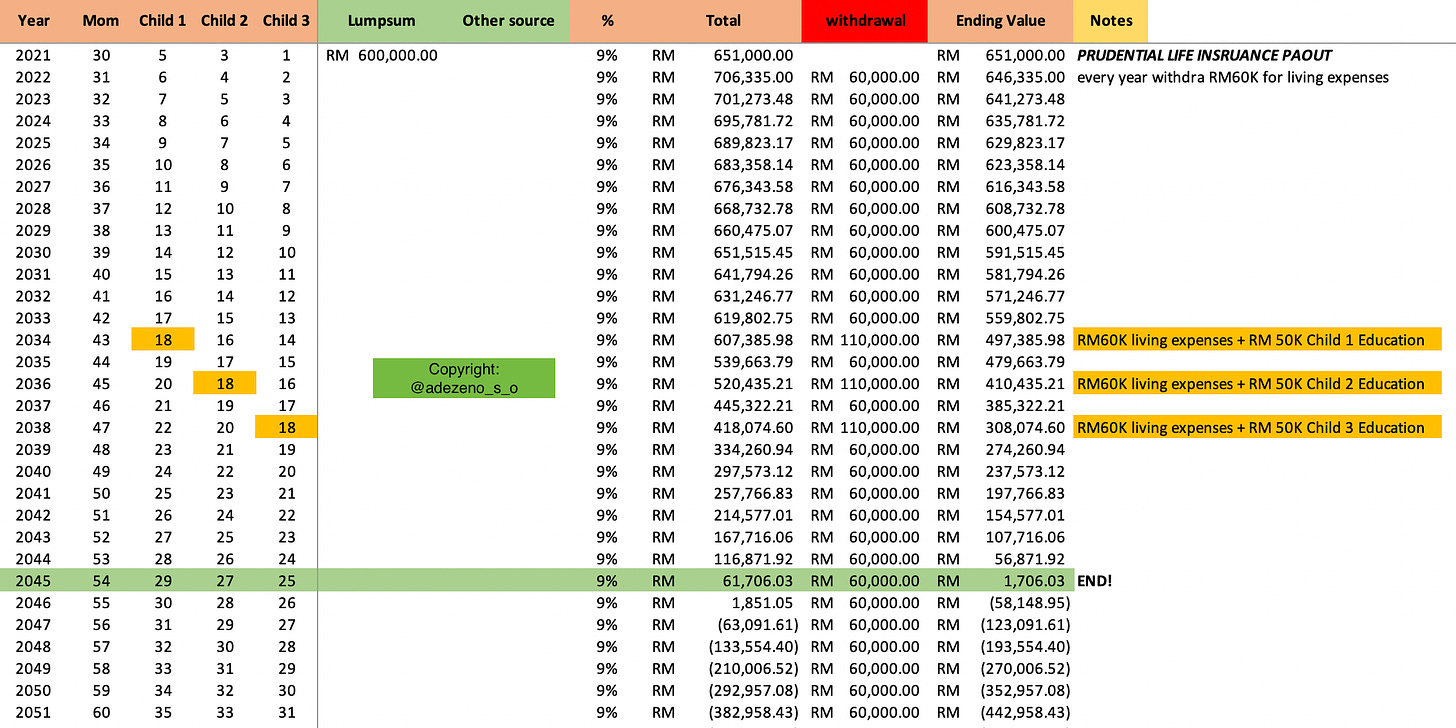

The Insurance premium payout is placed in low to medium risk investment vehicles that can generate 9% per annual return.

we assume the mom will withdraw RM60K yearly, = RM5K/month as living expenses for the family.

Each Child is able to withdraw RM50K when they reached 18 years old to further their studies in local universities.

This simple planning alone can last the family 25 years without additional income from the mother.

Success is a residue of planning.

if you like this, you can subscribe to my newsletter here.

If you want me to plan something like this for your family, please DM me.